Featured

The Asset Revolution — The Next Big Short Cont’d

We’ve been at the forefront of the what we're calling "The Asset Revolution" since inception, yet we’re just getting started… building product and platform for a new way of living (with people + home at its core).

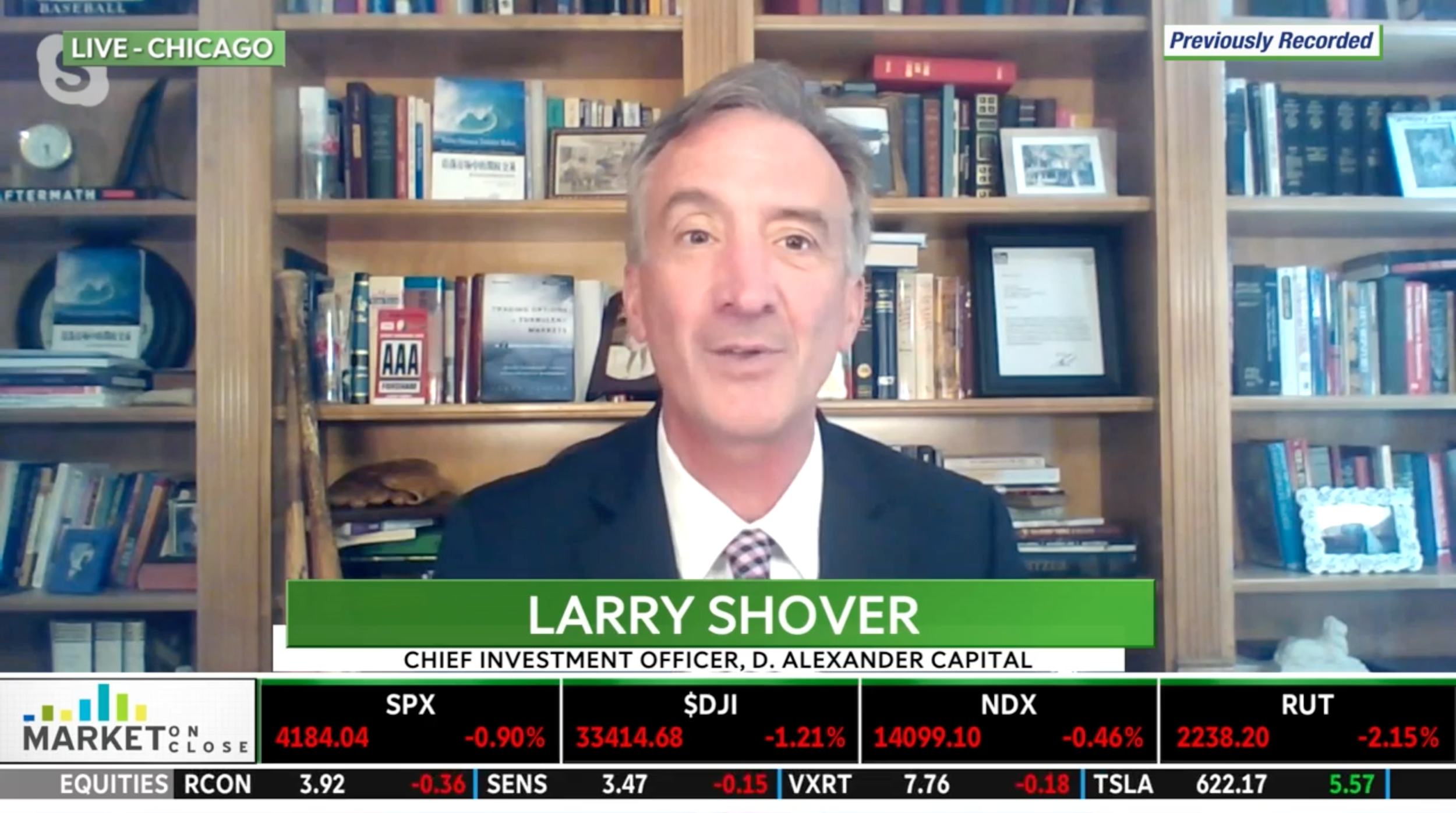

D. Alexander Capital CIO Shares Recent Economic Data and Global Micro Factors on TD Ameritrade Network

D. Alexander Capital CIO, Larry Shover, maintains that recent price action in the interest rate market is best characterized as a function of global macro factors, the solid US growth and inflation profile will remain a touchstone as this week’s auctions and economic data represent the latest challenges to the recent repricing in rates.

D. Alexander Capital CIO Discusses Treasury Rates on TD Ameritrade Network

“It is difficult to envision 10-Year Treasury rates below 1.00% without another unforeseen shock. Even a further pullback in equities won’t prove sufficient to drive such a rate repricing; unless, of course, it occurred rapidly and is accompanied by a pickup in equity volatility that serves to tighten financial conditions.” — Larry Shover, D. Alexander Capital CIO

D. Alexander Capital CIO Talks Borrowing Costs on TD Ameritrade Network

D. Alexander Capital CIO, Larry Shover, suggests that borrowing costs aren't permanently stuck in a low range, rather that further progress out of the pandemic and into the new normal will be necessary before interest rates begin to climb.

D. Alexander Capital CIO Discusses This Week’s Economic Data on Ausbiz

“The underlying motivations behind the recent drop in interest rates, while opaque, are not directly linked to this week’s economic data. Instead, the drop in rates offers a textbook example of an episode during which the price action itself has become the event.” — Larry Shover, D. Alexander Capital CIO

The Next Big Short…

“What’s bigger than the big short? The ‘Asset Revolution’ underway, powered by the people.” — Alex Allison, 7/4/21

D. Alexander Capital CIO Talks Housing Data and Employment Trends on TD Ameritrade Network

Larry Shover explains the overall apathy regarding both employment and housing data and why the grind toward lower yields appears to be the most identifiable trend as for the moment.

D. Alexander Capital CIO Talks Record High Stocks on TD Ameritrade Network

Range bound interest rates and record high stocks are thematic as we quickly approach quarter-end (as well as month and H1).

D. Alexander Capital CIO Talks Economic Recovery and Housing Data on TD Ameritrade Network

"Despite the undeniable relevance of employment and housing data at this stage in the recovery, I expect the interest rate 'range trade' will be the most identifiable theme of the week ahead going into next week." — Larry Shover, D. Alexander Capital CIO

D. Alexander Capital CIO Discusses Recalibration of Markets on Ausbiz

Replacing this economic reopening euphoria of the past few months is a sense that while the US is going to continue to steadily improve over the course of the year, the prospects are much lower for an inflationary spike that the Federal Reserve ultimately allows to run unnoticed.

D. Alexander Capital CIO Talks Housing Prices and Treasury Markets on TD Ameritrade Network

The process of recalibrating investors’ understanding of the Federal Reserves willingness to respond to an uptick of inflation and an accelerating real economy is the type of shift that will continue to impact the direction of US rates - and thus, housing prices - for some time.

D. Alexander Capital CIO Talks Housing Demand on TD Ameritrade Network

Housing demand continues to cool from the torrid pace through the turn of the year but demand should remain warm, with mortgage rates running in a record-low range, millennials pulling forward home purchase plans that were supposed to unfold over the next few years, and increased saving helping more would be buyers cross their down payment thresholds.

D. Alexander Capital CIO Talks Interest Rate Environment and Housing Market Data on AusBiz

Markets seem to be recalibrating to a lower-for-longer (long-dated) interest rate environment. D. Alexander Capital CIO, Larry Shover, discusses the potential effect of this on the consumer, the investor, and the housing market.

D. Alexander Capital CIO on TDA Network Discusses Recent Economic Data and Federal Reserve Meeting

It’s market environments such as this which present the risk of misreading the extent to which the largest factors are already priced into the US rates market. Perhaps the reason consensus appears so divided on the near-term pathway of interest rates.

D. Alexander Capital CIO Talks Market Moves and Today's U.S. Employment Report on TD Ameritrade Network

Mortgage buyers relieved as interest rates drop post today’s jobs report showing progress albeit more is needed.

D. Alexander Capital CIO on FOX BUSINESS, Sharing Social Media's Impact on Markets

Today’s social media tools have far greater reach, scale, and anonymity than previous technologies. This raises a potential issue: the possibility that people will attempt to use these powerful forums to hype certain stocks or manipulate markets.

D. Alexander Capital CIO Shares Takeaways from Recent Economic Data on TD Ameritrade Network

In the week ahead, the market will spend the bulk of the pre Non-Farm Payrolls period contemplating the degree to which the economic data has once again become relevant to the macro outlook... or not.

D. Alexander Capital CIO Talks Lower Interest Rates and Impending Housing Data on TD Ameritrade Network

Interest rates finish the week lower and housing data slows from a very high level. D. Alexander Capital CIO, Larry Shover, talks why he feels rates will be lower for longer and its impact on housing prices.

D. Alexander Capital CIO on Ausbiz — Market Should Remain Solid This Year as More Jobs Come Back

The combination of a modest climb in borrowing costs and a big jump in house prices has clipped affordability, though it remains historically very healthy. At the same time, lean listings have reduced buyer choice. Still, while the market has lost a step, it should remain solid this year as more jobs come back.

D. Alexander Capital CIO Talks Inflation on TD Ameritrade Network

The most recent housing data, the S&P Case-Shiller Home Price Index, is already up 12.0% y/y in February. Keeping with the pattern, this was the fastest pace of home price inflation since the late 1970s apart from a 23-month run during 2004-2006.